Mark O’Callaghan

November, 2025

- Sparkling wine is one of – if not the – best stand-out wine success stories in the world;

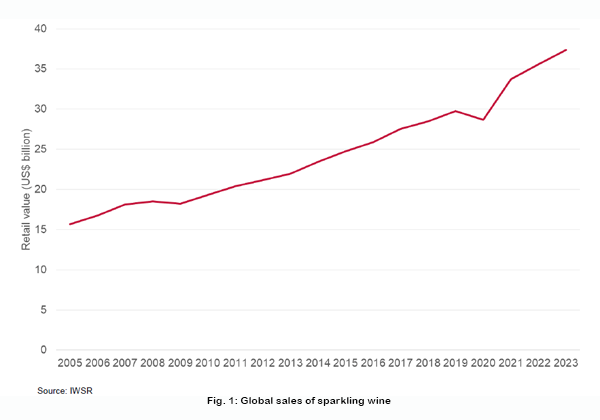

- Global sales have been growing steadily for over 20 years, totally outperforming still wine;

- The growth is in the $20-$30 per bottle range: one of the few that can deliver both volume and margin;

- The opportunities are both at home and in export where Australia is under indexed;

- Many aren’t familiar with the finer points of sparkling winemaking (or costing), which presents another opportunity.

What would you say if I told you there was a wine category that had been in straight line growth for 20 years amongst a price range that can be done with volume, margin and relatively low working capital? That I was crazy?

What if I told you that same category was dominated by brands perceived (perhaps unfairly) as relatively beige, making them vulnerable? Well, the data is compelling and it might be wise to understand it before your competitors do.

There are many good sources but two recent reports in particular are worth reading: Wine Australia’s Market Bulletin on sparkling wine sales and the State of the Grapes report from the Endeavour Group.

Principal amongst them is this chart (Fig. 1) from Wine Australia (via IWSR) that shows the steady global growth of sparkling wine consumption over the last 20 years. We all know there are many challenges and layers to it but there are very few – if any – wine styles that can make the same claim. If that’s not enough to get your attention, the demographic underpinnings (see the Endeavour report) suggest that there’s every reason to believe it will continue and growth is in the A$20-A$30 range. This zone steers clear of the profitless charnel house at the bottom of the market, sits neatly above the main prosecco range and continues to benefit from rising Champagne prices. It should come as no surprise that there is very little sold above $50 anyway, even though the top end Australian sparkling wines are on fire at the moment.

Please forgive me for stating what should be obvious but being on top of costs is critical. At A$25 per bottle there are only a handful of fully automated robotic sites around the world that can do bottle-fermented winemaking (traditional method and transfer) without going broke. Everyone else needs to be more realistic. There are still plenty of things one can do to fine-tune entry level sparkling wines to make something perfectly delicious and bring customers a little joy without over-making them and losing money. We’ve helped clients do exactly that over the years and the wines have become some of the most profitable SKUs in their portfolios. I still shake my head when I scan the sparkling section in chain stores, knowing how most of these wines are made and making note of who is going backwards. Spoiler alert: it’s not the glass manufacturer, the retailer or the ATO.

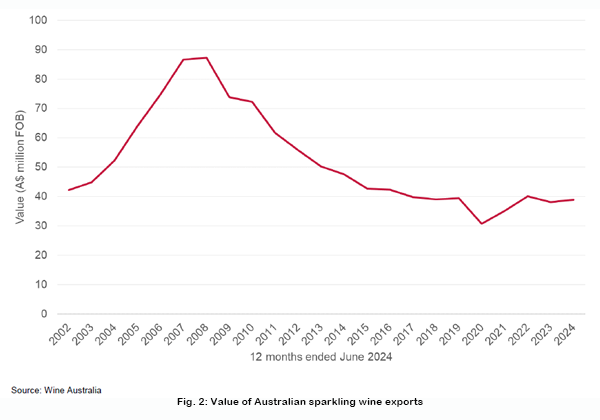

Whether the next chart (Fig. 2, value not volume) speaks to opportunity, warning, or both depends on how one sees the half-full glass but it is the awful export performance of Australian sparkling wine over the last 15 years. It follows the high growth, low inflation period before the GFC, then collapsing to below where we were 20 years ago – all of that in a growing market. Being under indexed can also indicate an opportunity.

Whether the next chart (Fig. 2, value not volume) speaks to opportunity, warning, or both depends on how one sees the half-full glass but it is the awful export performance of Australian sparkling wine over the last 15 years. It follows the high growth, low inflation period before the GFC, then collapsing to below where we were 20 years ago – all of that in a growing market. Being under indexed can also indicate an opportunity.

Again, there are many perfectly understandable reasons, there were some key businesses that were overrepresented in that sector and it will take hard work to get back there but at the enterprise level, there is still opportunity. Getting the branding and positioning right can be a little different to still wines, but it is just as important as quality and sadly, I still don’t think Australia does the first bit as well as the second.

Finally, to the nitty gritty of production. One of the best mentors in my career once described sparkling winemaking as the most technically demanding of all the various styles and he’s right. Being mostly dominated by specialist teams within relatively large companies, the cohort who really have the fizz chops is pretty small and it shows. Some of what we see out in the wild is a little disappointing but again, therein lies the opportunity if you choose to see it that way. Our team has collectively spent so much time in and around sparkling wine that we’ve probably been guilty of taking some of that knowledge for granted but at the same time we just see so much untapped potential out there. Innovation doesn’t have to mean inventing the iPhone, it may just be something ‘new to you’.

We’ve presented workshops on these topics in the past, covering the full spectrum from commercial offerings to very expensive prestige cuvées but the only topic in town at the moment is profitability. With that in mind, we have some workshops in development that are very commercially focused indeed, so stay tuned.

If it was easy, then everyone would already be doing it of course but the fundamentals of the business case are still pretty exciting. With so much of the wine world being so brutal at the moment, just being able to use positive language like this is refreshing.